Read Below to Learn More About Buying a Property in GTA

Contents

- INTRODUCTION TO BUYING REAL ESTATE

- CHOOSING A REAL ESTATE AGENT

- BEGINNING YOUR SEARCH

- LOOKING AT PROPERTIES

- OFFER TO PURCHASE

- CLOSING THE SALE & Land Transfer Tax

- MOVING TIPS

- CONCLUSION

I. INTRODUCTION TO BUYING REAL ESTATE

People tend to invest their money in real estate and the stock market, both of which have their peaks and valleys. Of these two popular investments, real estate tends to dip for less time than it peaks; there are longer periods of sustained growth, shorter valleys, and over time, the trend is always upward.

People tend to invest their money in real estate and the stock market, both of which have their peaks and valleys. Of these two popular investments, real estate tends to dip for less time than it peaks; there are longer periods of sustained growth, shorter valleys, and over time, the trend is always upward.

Here are some things you should know about investing in real estate:

If you plan to live in your property for more than five years, you are in a great position. You will have the benefit of being able to ‘time the market’ and sell when it is to your advantage. In this case, your home is also a lot more than a tangible investment in your future – it is a place for you and your family to put down stab le roots in the community, while enjoying and personalizing your living space.

If you have bought your property mainly to generate rental income, and do not ‘have’ to sell it at any specified time, you are similarly in a good position to gauge when prices have hit their peak so you can sell at the height of the sellers’ market. In the meantime, all that rental income is paying for the mortgage, repairs, and upkeep.

Great Toronto’s housing market is known as an ‘end-user’ market because the majority of homes are purchased with the intention of being owner-occupied. However, some buyers do purchase investment property – often pre-completion condos, vacant land or homes in disrepair with the intention of making improvements and then selling. ‘Flipping’ properties requires skill, business acumen and a great deal of planning, and because the intention is usually to re-sell the property within a shorter period of time – you have to time it right.

Remember, there are other important financial benefits to owning property:

- Tax benefits for improvements made to the property

- Government rebate programs for eco-friendly renovations

- Homeowners can use the equity in their homes as security for other loans

- Building equity in your first home puts you in a good position to trade up to bigger and better houses as your circumstances allow

- Mortgages on investment properties are tax-deductible

Of course before you begin your search, it is crucial to examine your own personal and financial circumstances to determine whether now is the right time for you. Here are some key points to consider:

- What monthly payments (mortgage, taxes, utilities, etc.) can I afford?

- How much can I afford for my down payment?

- Do I have funds set aside for closing costs?

- Is my job stable?

- Are my needs (job change, starting a family, etc.) likely to change in the next 12-24 months?

- Do I have time and energy for this process? (looking for homes, notice given to landlord, baby on the way etc.)

- Do I have a home that I want to sell first?

Ideally, find out about your mortgage options before you start looking. There is nothing more frustrating than falling in love with a home, only to find out you cannot afford it. Pre-qualifying for a mortgage is the best way to discover how much you can afford. Your banker or financial planner will look at your income, expenses and debt to determine how much a lender will lend.

II. CHOOSING A REAL ESTATE AGENT

Once you have decided that the time is right for you to buy a property, you will want to choose a real estate agent to work with. More so in recent years, the question comes up: why should I use a real estate agent at all? With the surge in for sale by owner (FSBO) websites and the explosion of websites geared to helping Buyers find properties and research neighbourhoods, some people consider doing the job themselves. The fact remains that though you might find your ideal home on the internet, it is still essential to have an advocate who will help you every step of the way, from screening properties, to negotiating the best possible deal for you, to handling the dozens of transactional details. What are the potential dangers of not having a trusted professional guide you through the process?

Once you have decided that the time is right for you to buy a property, you will want to choose a real estate agent to work with. More so in recent years, the question comes up: why should I use a real estate agent at all? With the surge in for sale by owner (FSBO) websites and the explosion of websites geared to helping Buyers find properties and research neighbourhoods, some people consider doing the job themselves. The fact remains that though you might find your ideal home on the internet, it is still essential to have an advocate who will help you every step of the way, from screening properties, to negotiating the best possible deal for you, to handling the dozens of transactional details. What are the potential dangers of not having a trusted professional guide you through the process?

- Real estate agents have access to the Broker’s version of the Multiple Listing Service (realtor.ca) which receives immediate updates and contains more detailed information, while the public version has a delay in updates and contains less information.

- The Seller’s agent is looking out for his or her client, not for you – they will not negotiate fiercely on your behalf, so you could easily overpay for the house.

- Conversely, no counsel on current market value means you might lose your dream home by only a few thousand dollars in multiple offer situations.

- Serious problems with the home, including structural damage, may not be visible to the untrained eye and once the deal closes, you are stuck with the property.

- Complex clauses in the Offer to Purchase (drafted by the Seller’s advocate, not yours) may put you at a disadvantage in terms of payment arrangements and conditions.

- Your deposit money can be tied up for months in the event that the deal falls through; in extreme cases of fraudulent Sellers, that money can literally disappear.

- Once the deal is done, you are on your own in terms of the closing and any issues or problems that might arise.

Buying a home is a big step, both financially and emotionally. My clients are all happy to have had an experienced agent on their side. I will put all of my time and effort into helping you reach your real estate goals: I do not get paid until you are happily moved into your new home!

Here are some things to keep in mind when choosing your Realtor®:

- Go local – look for the top Realtor® in the area you want to live in. Your Realtor® should work in the area you want to move to – how else will they know what the local market is doing and what private opportunities might be under the radar?

- Check the agent’s track record of success over the years – a good Realtor® should know their stats. Ask to see their client testimonials, and search the content of their website, which should give you a good idea of how the Realtor® works for their clients.

- Choose an agent who often handles homes in your price range. If you are a first time condo buyer, choosing an agent who primarily sells luxury homes means you may not be getting the market expertise, time or energy they would devote to someone with more money to spend.

- Call one of the agents on your short list and speak to them, or a member of their team. If you enjoy the contact, then arrange to meet them in person to determine if they are the right fit for your unique needs and lifestyle. After the meeting, consider whether they seemed trustworthy, honest, realistic when discussing your home purchase, committed to you, motivated to helping you, and knowledgeable.

- Choose an agent who listens to what you want and who takes the time to explain things which are not clear to you. Ask questions!

- Ask what makes your Realtor®’s service special; what distinguishes them from the other agents out there.

- Choose an agent who is available on your time schedule. If you are only available to look at homes on Sunday, and your agent does not work on weekends, then find one who can accommodate you. Ask what provisions are in place for when your Realtor® is not available.

- Make your experience a ‘one-stop-shop’! Your agent should be able to assist you with other necessary real estate services, such as arranging a house inspection, recommending a mortgage broker and finding a real estate lawyer.

III. BEGINNING YOUR SEARCH

Before we look at homes in person, we will sit down for a full consultation so I can get a better picture of what your ideal scenario is. During this consultation we will discuss your homeownership goals and desires including your preferred neighbourhoods, the price range you are comfortable with, offers, closings and what to expect during the entire buying process in plain English. Of course, I am also there to answer all of your questions!

Before we look at homes in person, we will sit down for a full consultation so I can get a better picture of what your ideal scenario is. During this consultation we will discuss your homeownership goals and desires including your preferred neighbourhoods, the price range you are comfortable with, offers, closings and what to expect during the entire buying process in plain English. Of course, I am also there to answer all of your questions!

Here are some important questions to ask yourself when compiling your list of needs vs. wants:

- Where do I want to live? (community/general area)

- Are schools a factor?

- Do I want an older home or a new one? What style of home do I prefer? (detached, town home, condominium, multi-family, bungalow, other)

- How much renovation and remodeling am I willing to do?

- Is being close to public transportation important?

- Do I have special physical requirements, such as wheel chair access?

- Do I have pets to consider?

- What sort of lot would I like? (small yard, large yard, fenced, garage, patio/deck, other buildings)

- How many bedrooms do I need? How many would I like to have?

- How many bathrooms do I need? How many would I like to have?

- How big a house do I want? How many rooms? How many square feet?

- What features are important? (air conditioning, carpeting, ceramic tile floors, hardwood floors, eat-in kitchen, separate dining room, formal living room, family room, den, library, finished basement, separate laundry room, fireplace, workshop, other)

Another key factor we will consider is whether you already have a property to sell. The question of whether to buy first or sell first has a different answer for everyone and depends on the individual. It is always a risk to buy before you sell, but it is also a big inconvenience not to find a home and have to move into a rental for a couple of months while still looking for a house to buy! I have helped many Buyers choose which option is best for them while negotiating closing dates and conditions that work best for the planned move(s). If you have a home to sell, I can help you improve its salability so you will receive the highest market value for it, and find yourself in a win-win situation.

Throughout your home search, I am here to help you navigate the ups and downs. You can count on me to:

- Provide you with important information on real estate values, taxes, utility costs, services, and amenities

- Pre-screen the online properties you see, keeping your ultimate goals in mind so you are not wasting your time filtering through hundreds of property listings that match only some of your search criteria

- Recommend the best homes for personal viewing based on my expertise

- Make you fully aware of what your dollar will buy by finding opportunities, such as great homes nearby your main search areas, that you may not be aware of

- Guide you through the viewing process, showing you features you may not have noticed and problems you may not have spotted

- Advise you about your legal and financial options

- Recommend expert help when needed, such as home inspection and contracting serviceTop of Form

My goal is for you to have all the information you need to make well educated, stress free choices when the time comes to buy your home.

IV. LOOKING AT PROPERTIES

One of the hardest things to do when looking for a home is to remain objective. It is easy to fall in love with a home’s appearance, but it is also important to look beyond the outer layer, because appearances can be deceiving.

Here are some things to look for when viewing a home:

- General upkeep – is the home dirty or cluttered? Are the lawns uncut? If the owner has not bothered to keep the house looking clean and attractive, what problems could be lurking below the surface?

- Water leaks – water rots wood, undermines foundations, and leads to mould and mildew. Re-shingling a house or repairing a cracked foundation to stop water leaks can be very expensive. Stains, bulges and other signs of damage on ceilings or walls, and loose crumbling grout around bathroom & kitchen tiles could mean leaking water. It takes an expert eye to find many water leaks, so please feel free to bring a professional with you on our showing, or I can also arrange to commission a home inspection if the Seller has not already provided one from a reputable company.

- Does it work? – where possible, test the lights, faucets, toilets, furnace, air conditioning, and all major appliances that will be included with the home. Make sure everything is working as it should.

- Floors – should be smooth, even and solid, otherwise, repairs may be needed.

- Doors and windows – should fit snugly and operate smoothly. Look for flaked paint and loose caulking. Check for drafts.

- Outside – walk around the yard looking for areas where water might collect. Soggy areas near the foundation indicate poor drainage.

- Look for deep cracks in the foundations or loose mortar and bricks.

- Be sure to bring a measuring tape if you own large items such as a piano or a sectional that you want to keep.

Sellers are contractually obligated to disclose all problems in their homes that they know about, nothing can replace the expert opinion of a qualified home inspector.

A qualified home inspector can give the home a thorough examination, checking the heating and cooling systems, plumbing and electrical systems, the roof, attic, walls, ceilings, floors, windows, doors, foundation, basement, basically all visible structures of the home. They will point out the need for major repairs, identify areas that may need attention in the near future, and explain what level of maintenance will be needed to keep the house in good shape. Most inspectors are more than happy to tell you about the home’s good qualities as well, so you can decide if it is a good fit. A home inspection can help you determine whether or not to make an offer on a house, and if you decide to go ahead, just how much that offer is going to be.

V. OFFER TO PURCHASE

When I draft the legal purchase documents, there are five main elements to keep in mind:

- Price – this does not have to be the same as the Seller’s asking price but it usually helps, unless there is more than one offer, in which case it is advisable to bid higher than the asking price!

- Deposit – shows your good faith and will be applied against the purchase of the home when the sale closes. Should be at least 5% of the home’s purchase price.

- Conditions – standard conditions can include: subject to home inspection, subject to you obtaining financing, or subject to you selling your existing property. However, a condition can specify almost anything. Sellers obviously do not like to have their homes effectively ‘off the market’ while they wait for conditions to firm up, so the shorter the conditional period (i.e. 3-5 business days) the better chance the Seller will accept your conditional offer.

- Inclusions/Exclusions – your offer may be contingent on including certain items in the sale, such as appliances, fixtures and decorative items.

- Closing Date – the Seller will often specify the date or date range they would like to close on the property and your offer should closely match this. The closing date is the day the title of the property is legally transferred to you and the funds go to the Seller.

VI. CLOSING THE SALE

Congratulations! The Seller has accepted your Offer, and your dream home will soon be yours. Now what?

To guide you safely and comfortably through the closing period, which usually ranges from 30 to 90 days (but can longer or shorter depending on what was agreed upon when you bought the house), my team will assist me:

- Arrange Buyer Access visits to your new home for you, as outlined in the Agreement of Purchase and Sale, so you can see your new home and take measurements, plan interior decorating, renovations etc.

- Advise you on any inspections that might be needed, such as home inspections or mortgage appraisals.

- Recommend trusted tradespeople to you so you can start receiving quotes for any renovations you may wish to carry out once the home is legally yours.

- Provide you with valuable contacts to trusted professionals such as expert real estate lawyers, mortgage brokers and careful movers.

- Explain costs and fees to you, such as helping you calculate your Land Transfer Tax.

- Recommend moving tips and remind you of important things to do, such as switching your utilities over to the new home in time. Remember, there may be a pre-payment cost on taxes, hydro, gas, fuel, etc.

- Help you answer questions about your new property for your insurance company that you might not know the answers to.

- Check in with you on a regular basis to make sure everything is going well and you are prepared for the big move!

Below is some detailed information on the role of a real estate lawyer and on what you need to do when working with your lawyer and securing a mortgage.

Your lawyer should advise you what expenses you are likely to incur with respect to the closing procedures, including:

- Legal Fees + HST and Disbursements

- Disbursements: includes obtaining City Tax Certificate, City Zoning reports, City Engineering report, Sheriff’s Certificate, Title Insurance, Registry Office searches, registering the deed, registering the mortgage, couriers, postage, long distance calls etc.

- Land Transfer Tax: Both Ontario and Toronto taxes are payable by the Buyer through their lawyer upon closing of the transaction. First time Buyers do not pay the city of Toronto tax on the first $400,000 of a property purchase. Calculation of LTT for Buyers:

The formula for calculating Ontario Land Transfer Tax is:

0.5% on the first $55,000

Plus 1% of the amount from $55,001 to $250,000

Plus 1.5% of the amount in excess of $250,001 to $400,000

Plus 2% of the amount in excess of $400,000

The formula for calculating Toronto Land Transfer is:

0.5% on the first $55,000

Plus 1% of the amount from $55,001 to $400,000

Plus 2% of the amount in excess of $400,000

If you have bought a new home from a builder, the lawyer can give you an educated estimate as to how much you should budget for “hidden charges” such as:

- Ontario New Home Warranty Enrolment Fee

- Hydro and Water meter installation charges

- Fencing charges

- Grading Deposit charges

- many others

If all the conditions in the Agreement have been met and the Offer is firm, the lawyer proceeds to investigate the title to the property. Initial searches include:

- utility searches

- property tax searches

- building, zoning and planning searches

- registered title searches

A Tax Certificate is requested by your solicitor to verify the amount of the current year’s taxes and to ask about any arrears and outstanding charges for taxes. Your lawyer will also write to the Building and Zoning Department to get the full particulars of zoning by-laws and restrictions and permitted uses.

A Search of Title to the property is begun in the Land Registry Office to make sure the Seller is the true owner of the property, has the right to sell you the property, and that the property is not subject to any encumbrances, encroachments, easements, liens, agreements or mortgages that were not disclosed in the Agreement or Purchase and Sale. This search has to be completed prior to the Requisition Date (title search date) shown on your Agreement of Purchase and Sale.

A note on home insurance…if you are getting a mortgage, you MUST have fire insurance to cover the property from the day of closing. Let your insurance broker know the name, address, phone number and fax number of both your lawyer and of the financial institution providing your mortgage. Your lawyer needs a letter confirming that insurance coverage is in place effective on closing – this is super important because the bank will not advance the $ to close your purchase until they know that you have property insurance.

My services do not end when you have unpacked all the boxes. Please know that I am still just a phone call or email away, to help you with any questions, concerns or outstanding issues you may have about your new property.

VII. MOVING TIPS

Whether you are moving to your dream home up the street, or relocating due to a job transfer it can be really hard to uproot your life.

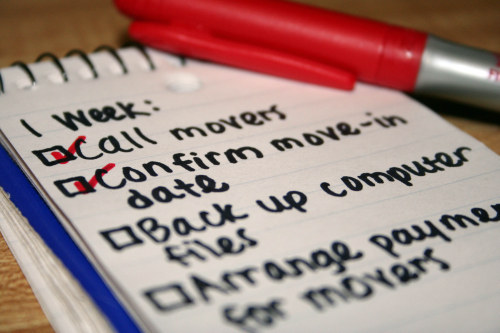

There are simple things you can do to make your move less stressful and less expensive. A good way to start is with a simple calendar beginning one or two months before the big day. Here is a sample timeline to help keep you on track:

One to Two Months Before Moving

- Walk through your current home and decide what you want to take, what you want to throw out, and what you want to donate to charity or sell.

- Arrange for important school, medical, financial, and legal records to be transferred.

- Book the movers: it is a good idea to obtain estimates from more than one company, not only to get the best price, but because likely not all of them will be available on the day you want to move. The estimates you get will depend on whether the movers pack everything for you, or whether you want to do the packing yourself.

- If you rent, give your landlord written notice and make arrangements for the return of any deposits.

- Inform gardening, newspapers, magazines, diaper and any other home services of your move. Now would be a good time to arrange for service at your new address.

- If you are moving far from your current home, you might want to consider transferring gym memberships and prescription records to a more local service.

- Change the address on your driver’s license effective the day of the move.

Three Weeks Before Moving

- Arrange to have your pets transported or boarded.

- Start preparing your plants for the move or, if it will be a long trip, consider giving them to friends, hospitals, libraries, or selling them. If you decide to move them, it is a good idea to prune plants and re-pot them into unbreakable plastic containers before putting them in cardboard moving boxes with holes punched in the sides for air.

- Get back any items you have lent (and give back any items you have borrowed). Pick up any items that are being repaired.

- Collect all items out for cleaning or repair, or in storage.

- Dispose of flammable items such as paint, aerosol cans and cleaning fluids.

- Send change of address information to the post office, bank, credit card companies and any other services where you get a monthly statement or newsletter. A good way to do this is to contact each company/service as your mail arrives to your current address. Canada Post allows you to change your address online and will forward your mail for four months for about $50.

- Start using up frozen food and staples. Do not buy any more than you absolutely have to before moving.

Two Weeks Before Moving

- Schedule a date for a service firm to disconnect and prepare the appliances you are moving.

- Start packing nonessential items.

- Arrange for a babysitter for moving day if needed.

- Start planning to disconnect utilities including phone and cable.

- Based on your return visits to your new home (your Buyer Access visits), draw up a floor plan for your new home and start planning your furniture arrangement.

- Have your oil tank read and filled and, if required, give the receipt to your legal professional.

One Week Before Moving

- Finish packing suitcases and basic essentials. Make sure valuable documents, currency, and jewelry are in a safe and easily accessible place.

- Drain garden hoses, lawn mowers and other machinery.

- Clean and dry the fridge and freezer.

- Take down items such as curtain rods, shelves, light fixtures and mirrors that you are taking with you.

- Dismantle large power tools, such as lathes and grinders.

Packing Day

- Leave a clear workspace for the packers.

- Identify fragile and valuable items, items you are taking with you, and items being left for the new owners.

Moving Out Day

- Do a final check for overlooked items. Make sure windows and doors are locked, lights are turned off, utilities are discontinued or turned off, and the keys have been left behind for whoever will be moving into your home.

Moving In Day

- Make sure the utilities are connected.

- Take another look to see if where you want your furniture to go is correct.

- When the mover arrives, check items unloaded against the inventory.

- Make arrangements for installation of appliances. Confirm unpacking requirements.

VIII. CONCLUSION

As Torontonians, we are lucky to have such a beautiful, vibrant city with picturesque neighbourhoods that are ideal places to live, work and play. When it comes to finding the right community for you, it is not so much a matter of finding one as picking the best of many!

Here are some of the things you may want to consider when choosing where your next home should be:

- Explore the neighbourhood in person, keeping an eye out for signs of neglect such as run-down houses and litter in yards and alleys.

- If you have children, education is probably paramount. Are there schools within walking distance or will your children have to take the bus? How do the local schools compare? If your children need them, are there religious, private or special training (i.e. French Immersion, Montessori etc.) facilities nearby?

- Convenient public transport and major highways nearby can mean the difference between a pleasurable and not-so-pleasurable commute to work.

- Take a look at the local shopping district: does it provide all the shops, grocery stores, dry cleaners, restaurants, medical and dental offices, parks and recreation that you want? Do you want to be able to walk to all these amenities?

- Listen for traffic noise, barking dogs, low-flying airplanes, and any other noises that could be a problem for you.